“Life is like accounting, everything must be balanced” – Unknown

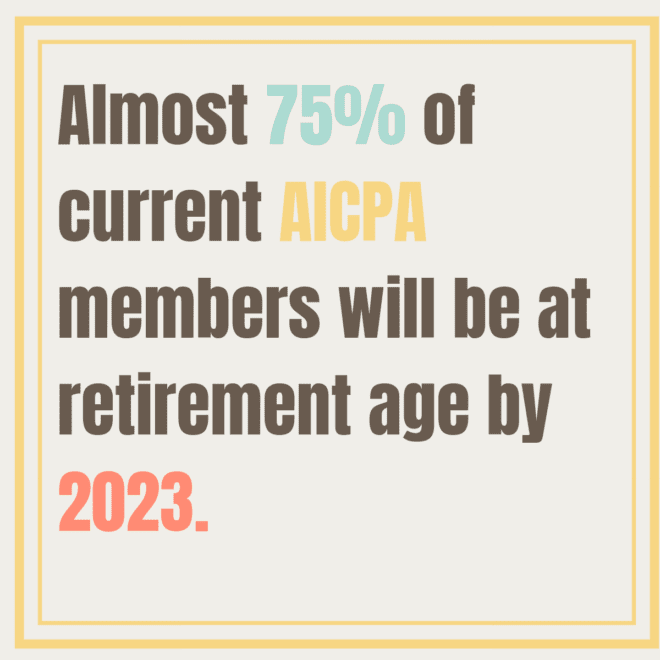

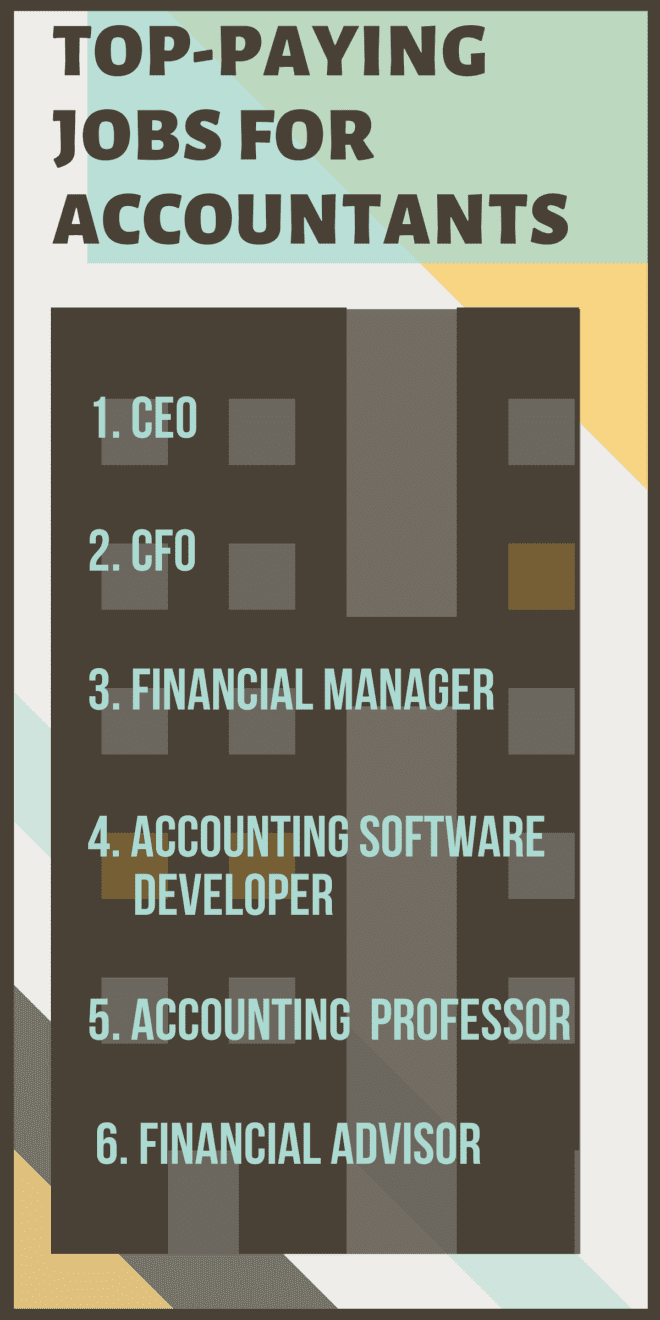

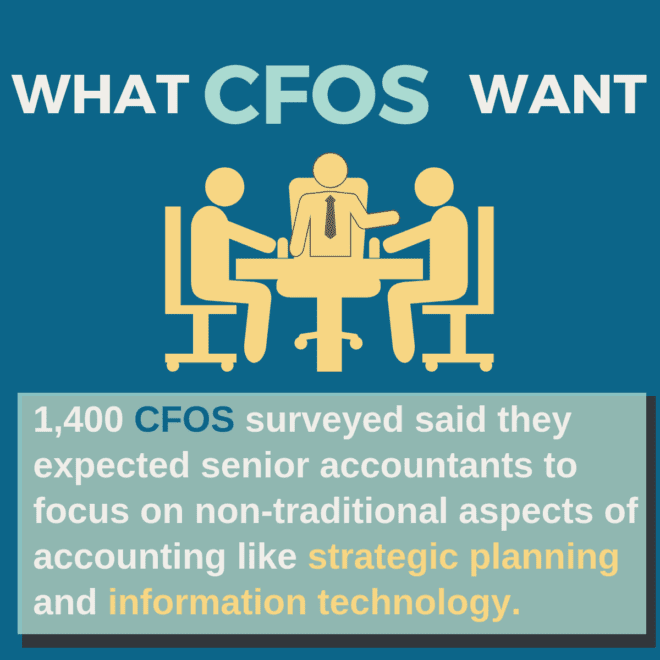

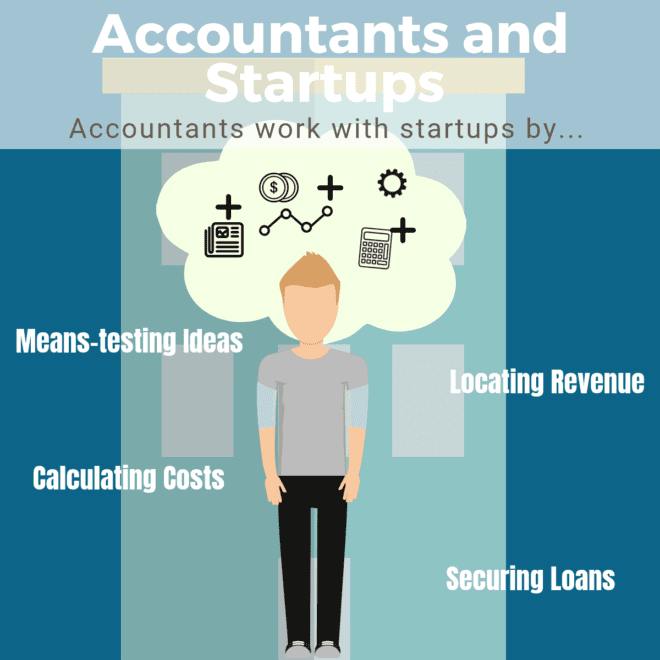

Accountants enjoy greater stability and report disproportionate job satisfaction in comparison with other professions. People who began their careers as accountants can be found working as CEO’s, CFO’s, Financial Managers, and in a litany of other powerful, lucrative positions across different industries. Accountants are known for their practicality, guidance and reliability, whether they’re working for an established business, individual clients, or a startup organization. In the coming years the field is also expected to see growth, evolution and widespread upcoming retirement among currently practicing accountants, making now a great time to begin your accounting career, especially if you can pair an accounting education with highly demanded skills in information technology and strategic management.

What is Accounting?

Accounting is the process of keeping track of financial transactions. Accountants record, organize, use, summarize and present financial information in analytical reports. These reports are used both internally for organizations and individuals to make sound financial decisions, and also externally, like to the government in tax reporting. Some accountants serve to advise clients and organizations, while others have influence over budgets, operations and other far-reaching organizational decisions.

How Do You Become an Accountant

Becoming an accountant means different things to different people. It’s possible to work in accounting without a degree, but eventually you’ll need at least a Bachelor’s and probably one certification (like the CPA) that you’re only likely to pass if you graduate from an accounting program. You’ll also likely need to work underneath a licensed CPA for 1800 hours. Each state has different rules about CPA certification, so make sure to explore the requirements where you live and/or plan to work. People working as accountants are able to prepare financial statements, tax returns (after passing an IRS test and/or receiving a Preparer Tax Identification Number). CPA’s are qualified to do audits and review financial statements.

Essentially, in order to become a highly functioning accountant that has job security and financial mobility, you’ll likely need to:

- Earn at least a Bachelor’s degree.

- Work underneath a licensed CPA.

- Take and pass the CPA exam.

- Consider earning further degrees and certifications, depending on your career goals.

Questions to Ask When Beginning Your Accounting Quest

If this all sounds good to you, you’re ready to pick an accounting program and earn a degree that gets you on the path to an accounting career. If you haven’t attended an undergraduate program, you’ll help yourself tremendously by picking an Associate or Bachelor accounting degree. When selecting a program, make sure to ask yourself the following:

- How much can you afford to pay for an accounting degree? Will you need to take out loans to make it possible to earn one? By earning an accounting degree online, you can often save yourself time and money.

- How much time do you have to earn your accounting degree on a daily and weekly basis, and how much time can you commit to it overall? Different programs have different schedules, and some will allow you to complete your degree quickly, while others let you learn at your own pace so you can maintain your current schedule and responsibilities.

- What’s the best delivery format for you to earn your accounting degree? There are online accounting programs, on-campus accounting programs, and programs that combine online learning with traditional learning in hybrid delivery formats.

- What specializations do accounting programs you’re looking at offer you? How will a potential concentration in accounting help you achieve your goals?

At Degree Query we’ve worked diligently to answer many of the most common questions related to accounting. Here’s some of what we’ve covered already:

Questions We’ve Answered On Accounting

Here are some of the common questions we’ve covered that will let you know how to earn an accounting degree quickly, show you what credentials you need for different accounting positions, let you know where in accounting you can make the most money, and much more:

- What Are the Highest Paying Jobs With an Associate’s Degree in Accounting?

- What Are the Highest Paying Jobs With a Master’s Degree in Accounting?

- What Are the Highest Paying Jobs With an Accounting Degree?

- What Is the Fastest School for a Master’s Degree in Accounting?

- What Is the Fastest School for an Associate’s Degree in Accounting?

- What Is the Fastest School for a Degree in Accounting?

- What Degree Does a Bookkeeper Need?

- What Degree Do I Need to Be a Tax Accountant?

- What Degree Does a CPA Need?

- What Degree Do People With a Job in Auditing Have?

- What Degree Do People With a Job in Management Accounting Have?

- How Much Experience Do I Need to Become a CPA?

- What Is the Difference Between an Associate’s Degree in Accounting and a Bachelor’s Degree in Accounting?

- What Is the Difference Between an Accountant and a CPA?

- How Do I Prepare for the CPA Exam?

- What Are My Degree Choices in Fraud Analysis?

Keep in mind this is just a light smattering of the questions we’ve answered to help you become an accountant. To see all of our coverage on accounting degrees, jobs, certifications and more, please do a search on the accounting section of Degree Query.

What are the Best Accounting Degree Programs?

Now that you know where to find answers to common questions you have about accounting, it’s time to explore where you should earn an accounting degree. We’ve created two incredible resources that can help you choose the best accounting degree program for you:

Top 10 Accounting Degree Programs: On this ranking you’ll find ten incredible schools that offer accounting degrees at the undergraduate, graduate and doctoral levels. We’ve also included schools charging anywhere from $5,000-$50,000 in tuition so you can choose an affordable program.

Some of the top schools on our rankings include the following:

- University of Illinois–Urbana-Champaign: offers a 5 year program in which students will earn a Master’s and a Bachelor’s in accounting, and can choose concentrations in finance, taxation, supply chain management, business and public policy, corporate governance and information technology.

- Indiana University–Bloomington: This school features very affordable in-state tuition ($10,388) and admits 76.1% of applicants.

- Brigham Young University–Provo: BYU is one of the most affordable schools we’ve ranked, with tuition for members of the Mormon Church coming in at $5,150, and $10,300 for non-members.

- University of Alabama-Birmingham: UAB’s 100% online accounting Bachelor’s costs $400 per credit hour and prepares students for the Certified Public Accountant (CPA), Certified Fraud Examiner (CFE), and Certified Management Accountant (CMA) exams.

- Colorado State University – Global Campus: This program features professors who were specifically trained to give online instruction, and prizes “accounting fundamentals and a comprehensive view of organization management issues including legal compliance and ethics, finance, marketing, leadership, economics, and quantitative decision making.”

- Southern Oregon University: SOU’s online accounting program gives students access to two tracks, one in which they can focus on public, private, or governmental accounting, and another track delving into management or systems accounting.

What Can You Do With an Accounting Degree, and How Much Can You Earn in Common Accounting Positions?

People who begin their career as CPA’s or accountants end up in many different positions. At its core, accounting teaches you how to make practical, financially viable decisions, and gives you a wealth of knowledge about finance, budgets, taxation and much more. Because of this, the experience and the skills you build in an accounting program are transferable throughout the business world, and in any organization seeking sustainability and longevity. However, here are some of the common jobs you can qualify for with an undergraduate education and/or certifications like the CPA, among other common certifications in the field.

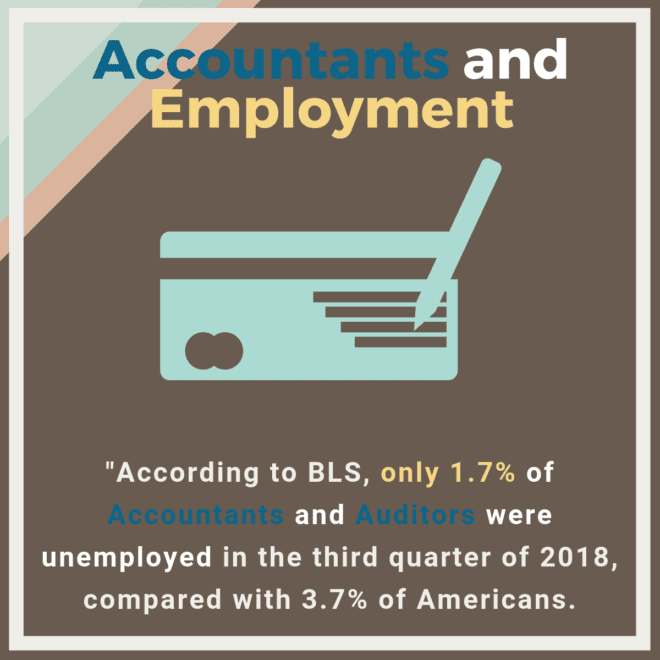

- Accountants and Auditors analyze the financial records of private citizens, companies and corporations, making sure the records are accurate and comply with tax codes. In 2017 the median annual salary of $69,350, and the number of people employed in these roles was 1,397,700, according to the Bureau of Labor Statistics. BLS predicted 10% job growth in these positions over the next decade.

- Financial Examiners work ensuring companies, corporations, and financial institutions comply with laws governing financial transactions. Many financial examiners work for federal, state, or local governments.

The median annual average for people in these roles were $81,690 in 2017, and 52,500 people were working in them in 2017, with that number expected to increase by 10% over the next decade, and that’s faster than average. - Financial Analysts help businesses and individuals make smart investments and build sustainable strategies. They need a good understanding of stocks and bonds on Wall Street. The median pay for these roles in 2017 was $84,300 according to BLS, with 296,100 people working in those roles. BLS also predicted an 11% increase in these jobs over the next decade.

These roles are great, but after five years in the field and perhaps a graduate degree, you can expect to step up to more lucrative positions with greater responsibilities, like the following:

- Financial Managers are expected to supervise the financial state of companies, corporations, and institutions by creating strategies that accomplish organizational goals. In 2017 the median income of these roles was $125,080, and there were 580,400 people in them. BLS predicted 19% job growth in these roles over the next decade.

- Top Executives are the professionals in charge of controlling organizations from the top down. In 2017 they earned a median annual salary of $104,700, and the number of people employed in these positions was 2,572,000. BLS predicted there would be an 8% job growth in these roles over the next decade.

- Sales Managers are in charge of organizations sales teams and need to have a detailed understanding of marketplace dynamics. In 2017 BLS found there was a median annual salary of $121,060, and there were 385,500 people employed in these positions. BLS expected a 7% growth in these roles over the next decade.

Let’s take a look at all of the different levels of accounting degrees.

What Accounting Degrees Can You Take?

Certificate or Diploma in Accounting: These programs generally take a year to complete, and cover fundamentals of accounting, bookkeeping, and payroll, among other foundational aspects of accounting. Graduates will be qualified to work as low-level bookkeepers or clerks.

Associate’s in Accounting: Here you’ll most likely study for two years (approximately 60 credit hours) and will prepare you to work in the most entry-level bookkeeping or clerk jobs, as well as transfer to a four-year accounting program. Often the school that conveys an associate’s degree in accounting has agreements with four-year universities to make your transfer and completion of your Bachelor’s easy and painless.

Bachelor’s in Accounting: In these programs you’ll take 120 credit hours (unless you already earned 60 in an associate program). You’ll focus on accounting, business, math, statistics, and finance courses and qualify to take your CPA exam and become licensed as a CPA, or in one of the other highly demanded accounting certifications.

Maser’s in Accounting: These programs generally take one to two years and give you advanced skills in accounting theory, practice, and a specialization (more on that next). One excellent option for these programs are MBA’s in accounting, in which you’ll get a graduate business education alongside higher level accounting courses.

Ph.D. or DBA in Accounting: These programs take anywhere from a year to 4-5 years to complete and are the final levels of accounting education. DBA’s generally are for people who want to work at the highest levels of business and accounting, and most graduates with PhDs in accounting will continue on to become college professors, but can also end up as high-level accountants, personal finance managers, or other executive business positions.

What Kind of Specializations and Focuses are there in Accounting?

All programs are different, but earning an accounting degree in a specialization that reflects your goals in the field is a great way to set yourself apart from your peers and build skills in highly demanded aspects of accounting. Here are some common specializations that can refine your accounting education:

- Accounting Information Systems

- Forensic Accounting

- Actuarial Science

- Manufacturing Cost Accounting

- Financial Accounting

- Tax Accounting

- Economics and Finance

- Information Technology

What Are Common Courses in an Accounting Program

Here are some typical courses you can expect to take across all accounting programs. You can read up on any of these and give yourself a leg up in your studies:

- Principles of Financial Accounting

- Federal Taxes and Business Strategy

- Accounting for Mergers, Acquisitions and Complex Financial Structures

- Financial Reporting and Disclosure

- Financial Statement Auditing

- Payroll Accounting

- Internal Reporting Issues

- Financial Modeling and Analysis

What Skills Can You Build in an Accounting Degree?

The skills you build in an accounting program apply throughout your career and life. As we’ve mentioned people who begin their careers with an accounting education end up in all kinds of influential and supervisory positions across different industries and sectors. That’s in large part due to the abilities and aptitudes accountant programs foster.

Accountants will become well-versed in:

- Organization and Time Management: Accounting involves so many different facets that your ability to schedule your time and prioritize problems and solutions will grow exponentially throughout your time studying accounting.

- Adaptability: Markets, organizations, and financial environments are in constant states of flux, so your ability to change your strategies and processes under pressure will be tested and developed throughout your accounting education and subsequent career.

- Communication: In accounting you’ll need to explain complex topics and how they impact organizations to people with little to no experience with them. Being able to distill what you’ve learned in a digestible way for non-specialists and have them understand its importance will be essential to your professional success.

- Leadership: Accountants often operate behind the scenes, but the most successful move up to have significant control of the organizations they work for and in. Making that transition will require the ability to demonstrate your value, and how you can effectively shape an organization to the benefit of everyone within it, and the people it serves.

What are the Most Important Accounting Certifications?

We’ve talked a good deal about the CPA certification, but it’s just one of the vital and lucrative accounting certifications you can earn in addition to your accounting degree(s). Here’s a look at some of the most common certifications that can advance your career and direct it towards certain areas of accounting and business that you’re interested in.

Certified Fraud Examiner: If you’re interested in fighting against fraud, identity theft and more, this certification is for you. It combines the inner workings of accounting and auditing with criminology and sociological study. You’ll learn how to spot signs of fraud, interview and expose suspects, report on investigations, testify at trial, and much more. You’ll need a Bachelor’s degree in a related field (business, accounting, etc.), and take then pass a certification exam, as well as become a member of the Association of Certified Fraud Examiners (ACFE).

Certified Information Systems Auditor: By earning this certification, you’ll demonstrate an ability to monitor and safeguard information technology and business systems. You’ll use an auditor’s knowledge and computer science skills to make yourself an invaluable part of an organization. The need for these roles is on the rise, and by taking and passing the CISA exam, you’ll be ready to help fill them.

Enrolled Agent: Here you’ll become federally certified to represent taxpayers who are dealing with Internal Revenue Service audits, collections, or appeals. You’ll need the ethical decision-making of a lawyer and the knowledge of a tax professional. To become qualified you’ll need to work for the IRS for five years or alternatively pass all three parts of the Special Enrollment Exam (SEE) and a background check.

Certified Management Accountant: This is similar to becoming a licensed CPA but has more of a concentration on cost accounting, financial planning, and management. You’ll need to pass the CMA exam, and should consider joining the Association of Accountants and Financial Professionals in Business.

Certified Payroll Professional: In these positions you’ll need three to five years of professional payroll experience, take a number of courses and pass the CPP exam. Then you’ll be qualified to work as a payroll administrator, administrative manager, and payroll specialist, among other positions.

Accredited Business Accountant: This is also similar to becoming a CPA but involves more financially based study and labor. You’ll specialize in financial accounting, financial reporting, financial statement preparation, taxation, managerial accounting, as well as business law and ethics, among other areas of study. You’ll need three years of related work experience, (two of which can also be satisfied with college credit), and to pass Practice 1 and Practice 2 in order to receive the ABA certification.

Forensic Accountant: Here you’ll work in accounting litigation and investigation. On the litigation side you’ll dissect economic issues involved with legal disputes, prevent legal confrontation by working towards settlements, and offer expert testimony. The investigative wing involves exploring theft, securities fraud, insurance fraud, identity theft and more. You’ll take an exam and fork over a litany of credentials to qualify for this certification.

Now that we’ve looked at the different jobs in accounting, essential on-campus and online accounting programs, certifications in the field and more, let’s explore the best places to ply your trade as an accountant once you’ve earned the credentials to do so.

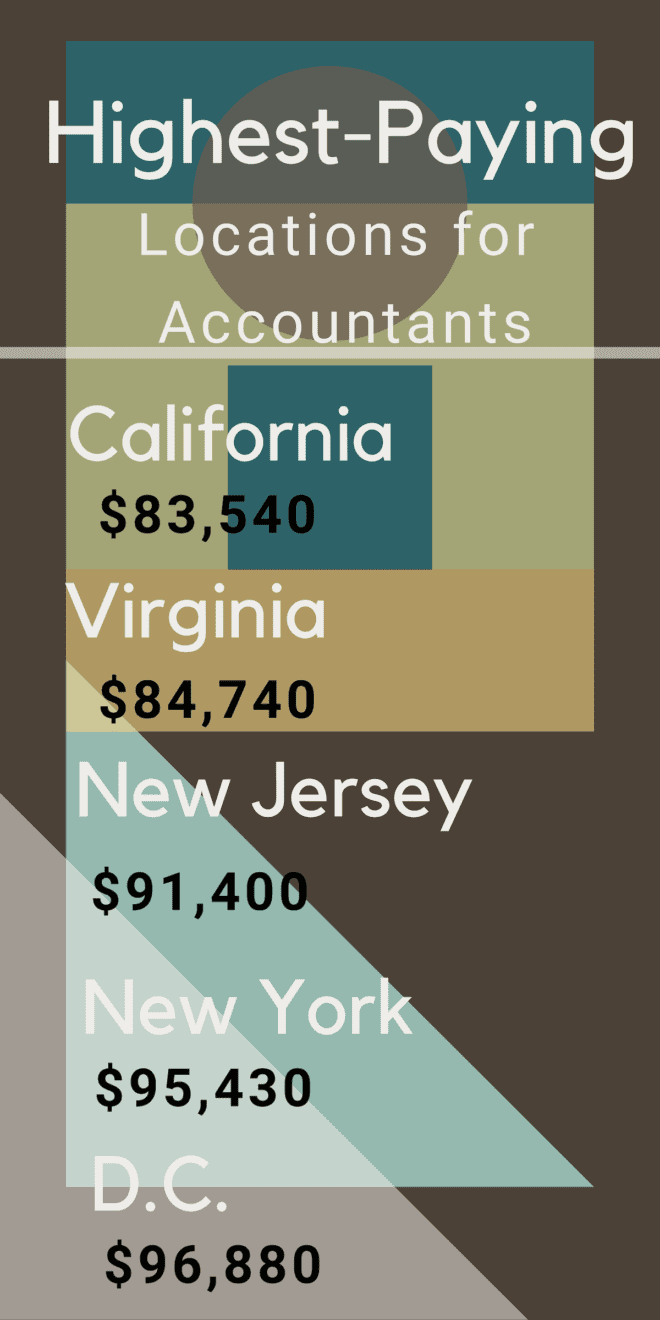

Where are the Best Places to Live and Work as an Accountant?

Planning on earning degrees and certifications is a great way to improve your career prospects in accounting. Another essential choice is where you’ll live and work. For example, if you’re looking to combine information technology skills with accounting, you might consider living in San Francisco or New York, where a lot of digital startups are headquartered. Overall, here are some of the top areas in America to live and work as an accountant:

- Washington, D.C. – Payscale Median CPA Salary: $79,327

- Philadelphia, Pennsylvania – Payscale Median CPA Salary: $75,212

- Seattle, Washington – Payscale Median Salary $75,178

- San Jose, California – Payscale Median Salary $72,000

- New York, New York – Payscale Median Salary $74,922

- Boston, Massachusetts – Payscale Median Salary $70,999

- Los Angeles, California – Payscale Median Salary $70,945

- San Francisco, California – Payscale Median Salary $70,721

- Atlanta, Georgia – Payscale Median Salary $70,157

- Detroit, Michigan – Payscale Median Salary $70,017

Accounting in Conclusion

Your career in accounting is in your hand. Unlike many industries, it’s extremely structured, and the steps for advancement are much clearer than more freewheeling sectors. At Degree Query, you can find an incredible library of resources that will aid you in your odyssey towards accounting superstardom. Make sure to reference all of the accounting questions we’ve answered about accounting, and our rankings of accounting programs.

For Further Reading:

20 Non-Law Firm Jobs with a Law Degree

What Are the 5 Best Careers in Environmental Science?