As a general rule, most people don’t find tax law particularly interesting. However, if you’re curious about the tax code and, specifically, how to use your knowledge of tax laws for strategic financial and business planning, you might make a great tax accountant. Pursuing an accounting or taxation program in college can help you prepare for a career in taxation.

What Do Tax Accountants Do?

Accounting is the field of business that is concerned with recording financial transactions and generating financial statements and reports. The field of accounting is broader than many people realize. While personal income tax season puts the field of tax accounting on the public’s radar, this is only one area of accounting.

What other areas of accounting should a prospective accounting student be aware of? Cost accounting focuses on measuring and recording the costs of doing business, while managerial or management accounting emphasizes the generation of data pertaining to business operations. Financial accounting concentrates on producing statements that report the financial health of a company, often for the information of lenders and investors.

What Is Tax Accounting?

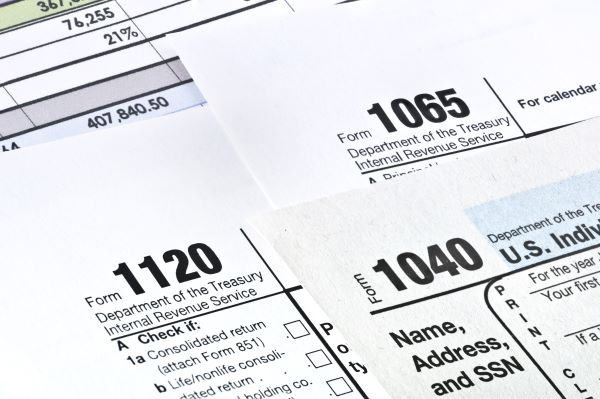

Tax accounting is one of the main branches of the accounting field. This branch of accounting encompasses all accounting efforts that pertain to the financial records and reports that are made for the purpose of complying with governmental tax authorities. The Internal Revenue Service (IRS) is the federal taxation authority in the United States. Individual states have their own tax authorities and regulations with which citizens and companies must comply, as well.

Tax Accounting as Public Accounting

The type of tax accountant that most commonly comes to mind for most people is a public accountant. Public accounting means that the accounting professional offers their services to the public – individuals and companies – rather than working in-house for one particular company, as a corporate accountant does. A tax professional at a tax preparation company or a certified public accountant (CPA) firm may spend much of their time preparing tax returns for individuals and companies and helping their tax clients plan for their tax obligations.

Corporate Tax Accounting

Some taxation professionals instead work in the field of corporate accounting, also known as private accounting. They work for one company or corporation rather than offering their services to the public. Corporate tax accountants are internal employees who perform duties that pertain to matters involving corporate taxes, including corporate taxation planning, preparing and filing business payroll tax returns and preparing income tax returns for the company.

Tax Accountants vs. Tax Preparers

A tax accountant is more than a tax preparer who merely plugs data into accounting programs to generate income tax returns. Tax accountants are well-versed in state, federal and international tax laws. They have the knowledge to identify and recommend ways for clients or companies to minimize tax liability legally based on existing tax rules. An experienced tax accountant can also answer questions about more complicated tax-related issues, such as gift taxation.

RELATED: If They Trust Me, Am I Allowed to Do Someone’s Taxes Even If I Am Not a CPA?

Tax preparers are responsible for generating and filing with government agencies the tax return data needed to pay income taxes. Tax accounting encompasses this work and more. Tax accountants don’t just produce tax documents but also perform tax planning work and develop a tax strategy in accordance with the tax code. As such, an experienced tax professional may serve as more of a tax advisor than a tax preparer and play a role in an individual or company’s financial planning.

Where Do Tax Accountants Work?

Tax accountants can work for a variety of employers. State and federal government agencies, like the Internal Revenue Service, employ tax accountants in roles like tax specialists, tax examiners, tax compliance officers and Internal Revenue Agents.

Public accountants usually work for accounting firms and tax agencies in the accounting, tax preparation, bookkeeping and payroll services industry. A public accountant specializing in tax procedure and planning may also be self–employed – as 5% of the accountant and auditor occupation as a whole is, according to the Bureau of Labor Statistics (BLS).

How Much Money Do Tax Accountants Earn?

If you’re considering devoting your career to the generation of financial statements, you’re certainly going to be interested in the financial data associated with the tax accounting occupation. Tax accounting can be a lucrative career path.

Your earning potential increases with experience, advanced education, professional certifications and the development of specialized skills and knowledge.

Median Salary Data for Tax Accountants

The United States Bureau of Labor Statistics (BLS) reported a median wage of $77,080 per year for accountants working in the accounting, tax preparation, bookkeeping and payroll services industry. Based on this data, you could conclude that tax accountants earn wages that are on par with other types of accountants. The BLS reported a 2021 median annual salary of $77,250 for the accountant and auditor occupation as a whole.

Tax Accountants’ Average Annual Salary

The median salary for an occupation is the midpoint salary – the figure between which half the occupation earns more and half earns less. The mean, or average, annual salary is another way of gauging earning potential. The average salary is the number you arrive at when you add all salaries for the occupation and divide that total by the number of salaries.

For entry-level tax accountants, classified as Tax Accountant I, Salary.com reported an average salary of $60,567, with most workers in the occupation earning between $54,530 and $67,612. Among intermediate-level accountants categorized as Tax Accountant II, Salary.com reported an average salary of $73,789, with most workers earning between $65,572 and $82,866.

The Tax Accountant III category, which consists of senior tax accountants, boasted an average salary of $91,229, Salary.com reported, and most workers earned between $83,242 and $100,591. Among the senior specialist accountants who make up the Tax Accountant IV category, the average salary is $115,055, and the average salary range extends from $102,479 to $129,837, Salary.com reported.

Corporate vs. Public Tax Accountant Salaries

Whether tax accountants go into the field of corporate accounting or public accounting affects their earning potential, too, according to human resource consulting firm Robert Half International Inc. If you’re basing your tax accounting career decision purely on earning potential, you’re going to want to gravitate toward corporate accounting rather than public accounting. At every level of experience, tax accountants working in the field of corporate accounting make more than those working in public accounting.

Tax accountants concerned with corporate taxation see entry-level salaries start at an average of $56,500 as of 2022, Robert Half reported. By the time tax accountants in corporate accounting have one to three years of work experience, their average mean salary rises to $76,000. Senior tax accountants in corporate accounting reported an average income of $93,250.

The tax manager role has the highest average wage in this occupation. Tax managers earn an average of $119,000 working in corporate accounting. Tax managers are the high-level taxation professionals who are responsible for overseeing an organization’s tax strategy and its preparation and filing of tax documents.

In the field of public accounting, entry-level tax accountants start out with an average salary of $50,250. Gaining one to three years of work experience raises the average salary of tax accountants in public accounting firms to $61,500. A senior tax accountant working in public accounting can expect to make $75,500, while a manager of tax services earns an average of $110,000.

What Level of Degree Do Tax Accountants Need?

If you want to be a tax accountant – not just a tax preparer, but a full-fledged accountant – you’re going to need a college education. A bachelor’s degree in taxation or general accounting is the minimum level of education needed for entry-level roles in accounting, according to the United States Bureau of Labor Statistics (BLS).

A tax accountant can have a fulfilling and lucrative career with only an undergraduate degree, but taking your education further with a graduate program can open up opportunities for advancement. You may benefit from pursuing a master’s degree if you want to rise to senior-level tax accountant roles like tax manager, develop the skills needed for more specialized positions or pursue professional certifications. Master’s in taxation and master’s in accounting programs may be of interest to tax professionals looking to advance their education and their career.

Accounting and Taxation Degree Requirements for CPAs

The most well-known accounting credential is certified public accountant, or CPA. If you decide you want to become a CPA, that choice may require you to go back to school.

Technically, a bachelor’s degree satisfies the required level of education necessary for becoming a CPA. However, under the current licensure requirements, aspiring certified public accountants must complete 150 credit hours of college study, while the average bachelor’s degree in accounting program encompasses closer to 120 credit hours.

This doesn’t mean that you must pursue a master’s in taxation degree if you want to become a CPA. Going for your master’s degree is only one of the ways students can fulfill this education requirement, according to the Association of International Certified Professional Accountants (AICPA). You might also opt to double-major as an undergraduate student, pursue a graduate certificate or take courses as a non-degree student.

Whichever choice you make, you should be prepared for the possibility that you may need more education, even if you don’t pursue the next level of degree, if you decide to move forward with your plans to attain CPA certification.

Is There Such a Thing as a Tax Degree?

There are tax degree programs, but they aren’t as readily available as degree programs in accounting more generally. Taxation degrees are far more specialized than the average accounting degree, which covers a variety of branches and methods of accounting practice.

RELATED: What Classes Will I Have to Take for a Degree in Tax Accounting?

Fortunately, you don’t need to graduate from a specialized degree in taxation program to work in the field of tax accounting. A degree in accounting often covers the coursework that is most necessary for aspiring tax professionals, including coursework in international taxation, federal taxation and the fundamentals of tax research.

Undergraduate Degrees for Tax Professionals

Most degree in taxation programs are offered at the master’s degree level. Bachelor’s degree programs are usually broader in scope than a graduate program, covering the fundamental principles and practices of all kinds of accounting work. However, that doesn’t mean that you can’t pursue studies specific to taxation as you work toward your undergraduate degree.

In bachelor’s degree programs in accounting, students will often take at least one course pertaining to taxation, such as a class on federal income taxation. Often, students also have the opportunity to pursue electives related to tax accounting, including tax research, tax laws, tax considerations in financial planning and special topics in taxation.

Students pursuing accounting degrees at the undergraduate level also take classes in financial accounting, cost accounting, managerial accounting, auditing and other aspects of the accounting profession, as well as business law and general business concepts.

A bachelor’s degree in accounting may take the form of a Bachelor of Science (BS) or Bachelor of Arts (BA) degree that situates major accounting coursework in a science- or liberal arts-based curriculum. However, it may also fit the structure of a Bachelor of Business Administration (BBA) degree. In a business administration program, the major coursework may include a greater emphasis on completing a business core that draws from different areas – like management, finance, marketing and human resources – as well as concentration courses more closely related to the principles of financial reporting.

Master’s Degree Options in Taxation

At the graduate level, students have the opportunity to delve deeper into an area of focus – including tax accounting.

The curriculum found in accounting or taxation master’s programs isn’t only more specialized than that found in an undergraduate degree program. The coursework is also more advanced. Graduate-level courses are more rigorous and more complex, and they build upon the foundational coursework students took during their undergraduate studies.

Taxation students might pursue a Master of Accountancy degree, a Master of Business Administration degree or a more specialized Master of Science (MS) degree in taxation. Which type of master’s degree you should pursue depends on what you want to do with your education. For example, a master’s in taxation degree may be your best option if you want to develop in-depth, specialized skills and knowledge of taxation for a role like tax manager. Tax managers tend to focus on compliance with tax regulations and the accuracy of financial reporting. On the other hand, if you aspire to be made a partner of a CPA firm that handles taxation, you may be better off pursuing an MBA. If you want versatility from your degree in taxation, consider a Master of Science in taxation.

Master of Accountancy

A Master of Accounting, Master of Science in Accounting or Master of Accountancy degree is a graduate-level program that has a narrower focus on the accounting profession than an MBA but a broader focus than a specialized taxation degree. This master’s degree can often be completed in as little as one year.

In a master’s in accounting degree program, coursework may include advanced financial reporting, advanced financial accountancy theory, advanced auditing theory and practice and corporate reporting and analysis. As taxes are an important part of the field of accounting, students will likely take some tax-focused courses, as well, such as studies of advanced federal taxes and analysis and planning in tax practice.

Master of Business Administration

A Master of Business Administration (MBA) degree is the least specialized option for taxation students. In an MBA program, students take classes in core business areas like management, economics and marketing, as well as courses in their chosen area of concentration.

Most MBA programs offer accounting as a concentration option. Students in this concentration might take classes in financial statement analysis, financial valuation, cost management, issues in financial reporting and accounting for mergers and acquisitions. A course pertaining to business taxation and the impact of taxes on business strategy may be of particular interest to established and aspiring tax professionals.

If you decide to pursue an MBA, you might consider looking for a degree program that offers a taxation concentration. Taxation concentration options are less widely available than general accounting concentrations, but this study option provides an excellent combination of core business coursework and specialized taxation courses.

Coursework in a taxation concentration focuses on preparing students for researching tax issues, analyzing tax data, making decisions pertaining to tax consequences, effectively communicating tax findings and learning to use technology for tax professionals. Some of the classes you may encounter in a tax concentration include tax research and the taxation of corporations.

Master’s Degree in Taxation

The most specialized master’s degree option is a master’s in taxation degree. A graduate-level taxation program prepares students for careers that require more extensive, specialized knowledge of the complex and ever-changing area of taxation.

In a master’s in taxation program, you should expect to delve into areas like tax procedure, tax research, federal taxation, international taxation and state and local tax law. Coursework in a master’s in taxation program will likely encompass studies of individual tax obligations and planning as well as the impact of taxation on estate planning and individual financial planning.

Naturally, much of the curriculum of master’s in taxation programs often pertains to corporate tax obligations and planning. For example, students in master’s in taxation programs might take courses specifically in partnership taxation and the taxation of flow-through business entities.

Degrees in Tax Law

Tax accountant and tax preparer aren’t the only careers in the field of taxation. Another option to consider is tax attorney. Tax attorneys are licensed lawyers who apply their expertise in law to helping people with problems that pertain to tax laws and the Internal Revenue Code.

RELATED: What Degree Do You Need to Be a Lawyer?

A tax attorney might assist clients with issues like back taxes owed or tax audits and mistakes. Additionally, a tax lawyer is in a unique position to act as a tax advisor, advising their clients on how business transactions, property acquisitions, estate transfers and changes to business structures may affect the individual’s or company’s tax liabilities.

You can’t be a tax attorney unless you go to law school and earn your Juris Doctor degree – the degree that qualifies you to be a lawyer and take the Bar Exam. In your law school studies, you will take courses in various types of law and legal practice, including tax law and business law.

Certifications in the Accounting Profession

Education isn’t the only factor that affects careers in tax accounting. Accounting professionals may advance their careers by earning professional credentials like the certified public accountant (CPA) license and the Certified Management Accountant (CMA) designation. A master’s in taxation degree can help you prepare for either CPA certification or the CMA credential.

Certified Public Accountants

For aspiring certified public accountants, the biggest obstacle to overcome – after completing your education, that is – is earning a passing score on the CPA exam. The four-part CPA exam includes a section on Audit and Attestation (AUD), Financial Accounting and Reporting (FAR), Regulation (REG) and Business Environment & Concepts (BEC).

Certified Management Accountants

The Certified Management Accountant credential, awarded by the Institute of Management Accountants, Inc., also requires candidates to pass an exam. The two-part CMA exam covers the topics of Financial Planning, Performance and Analytics and Strategic Financial Management.

Choosing a School for a Degree in Taxation

Whether you’re applying to undergraduate or graduate programs – in accounting, taxation or business administration – you have a big decision to make. Narrowing down your list of potential colleges isn’t easy.

RELATED: What Degree Do People With a Job in Tax Examination Have?

Some of the factors you should consider as you undertake your school search include:

Accreditation

Accreditation demonstrates that an institution of higher education or a specific degree program meets the high standards established by an outside organization. Ideally, students should look for a program where the school itself has attained institutional accreditation from one of the regional accrediting bodies and the business, accounting or taxation degree program is accredited by the Association to Advance Collegiate Schools of Business (AACSB).

Choosing a program that isn’t accredited may make it more difficult to qualify for CPA licensure. Some states require an education from a school accredited by the Association to Advance Collegiate Schools of Business as part of the licensing process, according to the Association of International Certified Professional Accountants. This requirement is only likely to expand to more states, based on recommendations from the National Association of State Boards of Accountancy.

Cost and Financial Aid

If you’re thinking about pursuing a degree in taxation or accounting, there’s a good chance that you’re already financially conscious. Earning a degree in taxation – even a master’s in taxation degree – doesn’t have to break the bank.

As you’re exploring schools, look at the cost of attendance, the actual cost after factoring in financial aid packages and the value of the education you’re receiving. A degree from a business school with an outstanding reputation may be worth spending more on, and factoring in the financial aid available to you can help you understand what amount of money you’re really likely to pay for your education (which is often not the same as the published tuition and fees amount).

Remember, earning a degree in taxation or accounting is an investment in yourself and your future. Like all investments, your college choice should be made based on research and smart decision-making skills.